The Betterment Checking Account is a digital checking account offered by the fintech Betterment, known for its automated investment services. Designed for those who want full control from their phone, no fees, and everyday rewards, this account combines convenience, savings, and modern features.

With cashback on purchases, ATM fee reimbursements, and no hidden charges, it’s a practical alternative to traditional banks, entirely online and integrated with other financial services. Learn more about how it works and what benefits it offers you!

Key Features

The Betterment Checking Account was created to deliver a fully digital experience focused on savings and functionality. For that reason, it comes with several attractive features, such as:

- No monthly maintenance fees

- No minimum balance requirement

- Free Visa debit card with cashback at select retailers

- Unlimited ATM fee reimbursements in the U.S. and abroad

- No foreign transaction fees

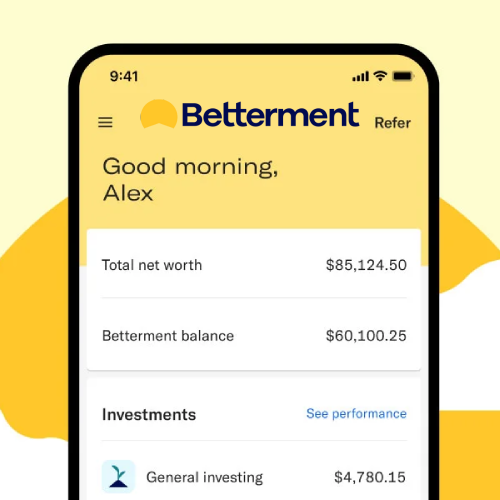

- Full-featured app for managing money, transfers, payments, and real-time tracking

- Direct integration with Betterment Cash Reserve (high-yield account) and investment services

Additionally, the account is FDIC-insured up to $250,000 through a partnership with NBKC Bank, ensuring your money stays protected.

What Are the Main Benefits of This Account?

Betterment Checking stands out for offering advantages to those who want a hassle-free banking experience:

- Automatic cashback at partner retailers when using the debit card (e.g., Adidas, Walmart, Levi’s, and more)

- No fees for maintenance, withdrawals, card issuance, or inactivity

- Digital payments with Apple Pay, Google Pay, and Samsung Pay

- Smart tools in the app, like subscription tracking and spending categorization

- Automatic ATM fee reimbursements anywhere in the world

- Easy transfers between checking, high-yield account, and Betterment investment portfolio

It’s the perfect choice for anyone who wants to combine financial control, cost savings, and investment integration all in one platform.

Fees and Conditions

The Betterment checking account is completely free in terms of banking fees, there are no monthly charges or withdrawal fees. It also doesn’t charge for international transactions, making it ideal for use abroad.

ACH deposits and transfers are free, but the account does not support check deposits, as it’s designed primarily for digital transactions.

Cashback is applied automatically when using the card at participating retailers. The reward amounts vary depending on the partner and are shown in the app before purchase.

Who Is It For?

The Betterment Checking Account is ideal for people looking for a simple, fee-free digital account with cashback rewards. Typically, these are young adults, freelancers, and digital nomads who want a platform that meets their financial needs online.

It also appeals to users already investing with Betterment who want to consolidate their finances. And for people who value mobility, especially travelers looking to avoid international fees, this account offers a positive experience.

As a more accessible, digital-first option, the Betterment Checking Account doesn’t have strict eligibility requirements and is available to anyone who wants a practical, fee-free account.

How to Open an Account

If the Betterment Checking Account caught your attention, the sign-up process is simple and fast:

- Visit Betterment’s official website or download the app

- Create a Betterment account (if you don’t already have one)

- Select “Checking” and click “Open Account”

- Provide your personal details (name, address, SSN, date of birth, etc.)

- Wait for verification and approval, usually within minutes

Once approved, you’ll receive your debit card and can use the virtual version right away while waiting for the physical card. Betterment also allows direct deposit for paychecks, making it a great option as your primary everyday account.

Is Betterment Checking Worth It?

The Betterment Checking Account is one of the most complete digital banking options for anyone looking to avoid banking fees, earn automatic cashback, and manage everything from their phone. With full integration into Betterment’s saving and investing services, it delivers a modern, cost-effective experience.

If you’re looking to escape fees from big banks and keep your finances 100% digital, this checking account might be the right fit, simple, accessible, and efficient.

All information in this and other BOISLA articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://boisla.com/category/banking/