Capital One 360 Checking is a full-featured digital checking account with no monthly fees and easy access through the mobile app and online banking. Designed for people who want simplicity, savings, and full control of their money, this account provides all the standard features of a traditional checking account, with modern benefits and no red tape.

Perfect for everyday use, 360 Checking combines convenience, security, and functionality, all backed by the strength of one of the largest banks in the United States. Here’s everything it has to offer.

Key Features

Capital One’s checking account delivers a robust set of tools to make your financial routine easier. Take a look at some of the main highlights:

- No monthly maintenance fees

- No minimum balance required

- Free access to over 70,000 ATMs in the Allpoint and MoneyPass networks

- Mastercard debit card with no foreign transaction fees

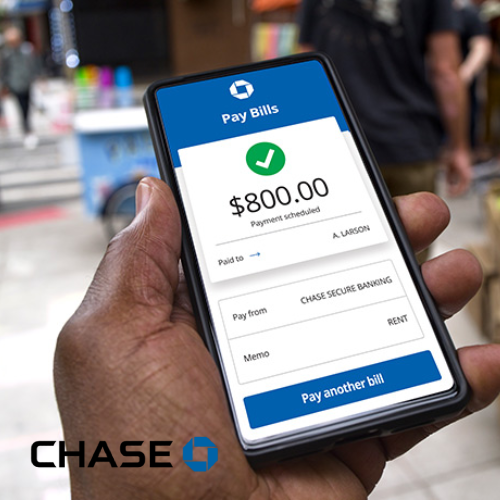

- Mobile check deposits, bill pay, and account linking

The account also lets you set up custom alerts, monitor transactions in real-time, and track your spending directly from the app.

Main Benefits

By combining smart banking tools with zero fees, Capital One 360 Checking stands out for the following benefits:

- No monthly charges and no hidden fees

- Digital tools for managing and tracking your finances

- Custom spending and purchase alerts

- Category-based expense tracking

- Built-in goal planner for budgeting

- Instant transfers with Zelle

- 24/7 customer support via app, chat, or phone

- Option to add joint accounts or link accounts for minors

You also get overdraft protection with three flexible options to help cover transactions that exceed your balance, adding a layer of security and convenience. This makes the account suitable for a wide range of users.