The Chase CD Account is the certificate of deposit offering from JPMorgan Chase, one of the largest and most established banks in the United States. Designed for customers seeking safety and guaranteed earnings, this product allows you to invest a fixed amount for a set term, receiving your principal plus interest at maturity.

With a variety of terms and competitive rates, Chase offers options for those seeking quick returns as well as for investors who can leave their money invested longer to benefit from higher rates. Here’s how it works and what it’s for.

Key Features

A Chase Certificate of Deposit (CD) works as a fixed-income investment with a predetermined term. The customer deposits an initial amount and commits to keeping it invested until maturity, avoiding early withdrawals to prevent penalties.

Main terms include:

- Minimum initial deposit: generally starting at $1,000, though this may vary by branch and customer type.

- Available terms: from 1 month to 10 years, with potentially higher rates for longer terms.

- Interest payment options: monthly, quarterly, semiannually, or at maturity, depending on your choice.

- Security: all Chase CDs are FDIC-insured up to the legal limit.

It’s important to note that this is not a savings account, returns are typically higher. CDs are designed for clients who want to diversify their portfolio with fixed-income investments, not just a standard savings product.

Advantages of a Chase CD

Choosing a Chase CD offers benefits such as guaranteed, predictable returns regardless of market fluctuations. Customers with a broader relationship with the bank, such as checking accounts or additional investments, may qualify for better interest rates.

Another plus is term flexibility, allowing you to choose anything from a short 30-day deposit to a long-term 120-month investment. You can also opt to have interest payments deposited directly into a checking account or reinvested to compound your returns.

On top of that, there’s the security and credibility of one of the nation’s most established banks, which offers various perks to loyal customers, including access to other Chase financial products.

Rates and Terms

The annual percentage yield (APY) on a Chase CD depends on factors such as the deposit amount, chosen term, and customer profile. For example, shorter terms typically have lower rates, while 12- to 60-month CDs tend to offer more attractive returns. Chase Private Clients often get the most favorable conditions.

It’s important to remember that early withdrawals trigger penalties, which may reduce or eliminate earned interest. That’s why it’s essential to select a term that aligns with your liquidity needs.

Additionally, rates may change according to the bank’s current policy, so it’s important to confirm yields and other account terms before opening a CD.

Who Is It For?

The Chase CD Account is best suited for those looking for a low-risk investment with predictable returns. It’s a solid choice for people who prefer to avoid stock market volatility and want a guaranteed rate of return.

It’s also a good fit for medium- to long-term financial goals, such as saving for retirement, buying a home, or funding a specific project.

This option is especially appealing for existing Chase customers who want to centralize their finances and take advantage of preferred rates. Since it’s not a standard savings account, it’s ideal for investors seeking broader fixed-income returns with professional management.

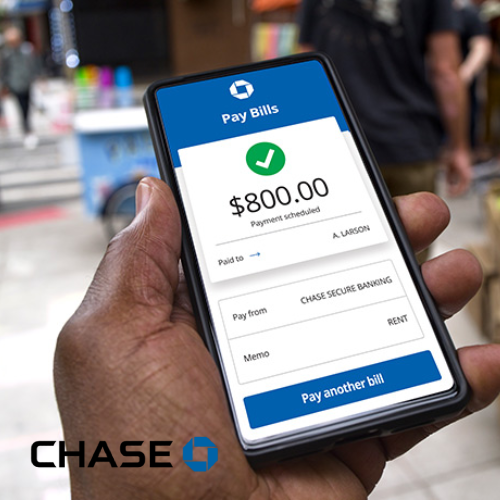

How to Open a Chase CD Account

Opening a Chase CD Account is simple. You can start the process on Chase’s official website or at a branch. The bank will request personal details, financial information, and the amount you want to invest. In many cases, you can transfer funds directly from a Chase checking account or another bank.

Once the deposit is confirmed, the term and interest rate are locked in and remain unchanged until maturity, providing predictable earnings. At the end of the term, you can withdraw your principal plus interest or roll it over into a new CD.

Is a Chase CD Account Worth It?

A Chase CD Account is worth considering if you value safety and stability in your investments. These CDs combine the strength of one of the largest U.S. banks with FDIC protection, ensuring your principal is secure up to legal limits.

Benefits include a wide range of terms, potentially higher rates for relationship customers, and zero risk of losing your initial investment. However, keep in mind that your funds are tied up until maturity, and early withdrawals can result in penalties.

For conservative investors who prioritize security and predictable earnings, the Chase CD Account is a solid choice, especially for those who already bank with Chase and can take advantage of special terms.

All information in this and other BOISLA articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://boisla.com/category/banking