The Chase Total Checking® Account is one of the most popular checking accounts offered by Chase Bank. Known for its wide network of branches and ATMs combined with advanced digital tools, this account delivers convenience, security, and multiple ways to manage your money.

It’s a solid choice for people who want easy access to traditional banking services paired with modern online features. With flexibility for deposits, payments, and transfers, as well as exclusive perks for Chase customers, it offers a well-rounded banking experience. Let’s take a closer look at how it works and everything it can offer.

Key Features

The Chase Total Checking® Account stands out thanks to a robust set of features designed to simplify everyday banking:

- Access to over 4,700 Chase branches and 15,000 Chase ATMs across the U.S.

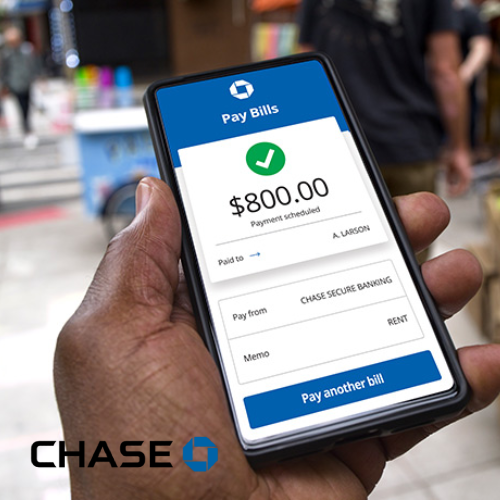

- The Chase Mobile® app, which allows you to pay bills, send money, deposit checks using your phone’s camera, and monitor balances in real time.

- Zelle® integration for instant transfers between eligible U.S. accounts.

- Mobile check deposit, so you don’t have to visit a branch to deposit funds.

- Fraud monitoring and protection against unauthorized use.

- Early Pay in some cases, giving you access to your direct deposit funds up to two days earlier.

- FDIC insurance up to $250,000 per depositor, providing peace of mind and account security.

These tools and protections make it possible to handle most financial tasks from anywhere, while still having access to a large branch network for in-person service.

Main Advantages

The biggest advantage of Chase Total Checking® is how it blends a strong physical infrastructure with a full range of digital services. Here are some of the benefits:

- High accessibility with thousands of ATMs and branches nationwide.

- Built-in money management tools in the app, such as spending alerts and expense categorization.

- Direct deposit for paychecks or government benefits, ensuring quick and secure access to funds.

- Advanced security features, including two-factor authentication.

- 24/7 customer support by phone, chat, or in person at a branch.

Another attractive perk is the potential to unlock additional discounts and rewards when you combine your checking account with other Chase products like credit cards, savings accounts, or investment services. Customers already using Chase products can maximize their benefits within the bank’s ecosystem.

Fees and Requirements

While Chase Total Checking® offers many conveniences, there are some fees and conditions to be aware of.

The monthly service fee is $12, but you can avoid it by meeting at least one of these requirements:

- Have $500 or more in total direct deposits each month.

- Maintain a $1,500 minimum daily balance.

- Keep a $5,000 combined balance across qualifying Chase accounts.

There’s no minimum deposit required to open the account, but out-of-network ATM withdrawals come with a fee, $3 per transaction within the U.S. and $5 per transaction abroad, plus any local ATM operator fees.

Who Should Consider It?

The Chase Total Checking® Account is designed for a wide range of customers. It’s ideal for those who value nationwide branch and ATM access and want a traditional bank account that’s also equipped with modern digital capabilities.

It’s a great fit for people who:

- Receive their salary or other payments via direct deposit.

- Prefer having both physical branch access and strong online banking tools.

- Want the added security and reliability of banking with one of the largest institutions in the country.

Because eligibility requirements are minimal, it’s also a good choice for individuals who are just starting their financial journey and want a dependable, easy-to-use account.

How to Open a Chase Total Checking® Account

If you’re interested in this account, here’s how to get started:

- Visit the official Chase Bank website or go to a local branch.

- Click “Open Now” (for online applications) and fill in your personal information, such as name, address, and Social Security number.

- Set up your initial deposit, if applicable, and choose how you want to receive your debit card.

- Activate your account and begin using it through the Chase Mobile® app.

The process is straightforward, and if you prefer in-person assistance, Chase representatives can guide you through each step at a branch.

Is the Chase Total Checking® Account Worth It?

If you value a large physical banking network, strong digital banking features, and the security of a major U.S. bank, the Chase Total Checking® Account is worth considering.

With easy access to thousands of branches and ATMs, a well-designed mobile app, and reliable customer service, it delivers convenience for both everyday transactions and more complex banking needs. While there is a monthly fee, many customers can avoid it by meeting the set criteria.

For those who frequently move money, receive direct deposits, or want to connect multiple Chase products, this account offers a comprehensive package of benefits, making it a dependable choice for managing your finances day to day.

All information in this and other BOISLA articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://boisla.com/category/banking/