Interested in the Capital One 360 Checking benefits? Then it’s time to look at how to get started. With broad access, modern features, and no fees, this checking account might be a perfect match for your needs. Here’s how it works and what you’ll need to do.

Rates and Fees

Capital One 360 Checking avoids the most common banking fees, making it a more accessible option for everyday banking. Here’s a quick breakdown of the cost structure:

- Monthly fee: $0

- Minimum deposit to open: $0

- Foreign transaction fee: $0

- Overdraft fee: avoidable with protection settings

- Overdraft line of credit (optional): subject to approval

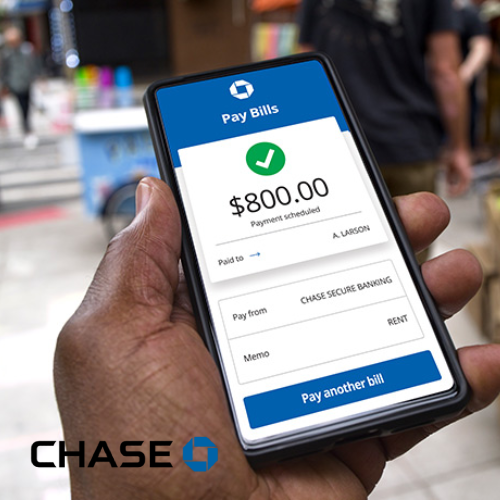

Despite being free to use, the account includes premium features like mobile check deposit, real-time notifications, and payment scheduling.

Keep in mind that some rates or terms may vary depending on location or bank policy updates, so it’s always best to check directly with Capital One for current conditions.

Who Is This Account For?

Capital One 360 Checking is a great fit for anyone who wants a 100% digital, fee-free checking account. With a focus on modern features and ease of use, it’s especially appealing to younger customers like college students or young professionals starting their financial journey.

But it also serves other groups well, such as families looking to manage a joint account or link access for dependents. It’s also a solid option for frequent travelers thanks to the $0 international transaction fees.

In terms of eligibility, a good credit history is helpful, typically a score of 600 or higher is recommended. Existing Capital One customers may have an easier time opening an account, especially if they already hold a savings account or credit card with the bank.

How to Apply for Capital One Checking

Opening an account is quick and easy. Follow these steps:

- Go to Capital One’s official website or download the mobile app

- Select “360 Checking Account” and click “Open Account”

- Fill in your personal information (name, address, Social Security number)

- Choose whether you want an individual or joint account

- Complete the identity verification and wait for approval

Once your account is open, your debit card will be mailed to your address and you can begin using your account right away through the app.

If you’re already a Capital One customer and want to connect your credit card or savings account, you’ll need to do this after the account is active. The process is simple and can be done through the app, no paperwork or extra steps required.

Is Capital One 360 Checking Worth It?

Capital One 360 Checking is one of the best digital checking accounts available in the U.S. With no fees, a wide ATM network, modern financial tools, and fast access to banking services, it serves a variety of customers—from young adults just starting out to families looking for convenience.

What sets Capital One apart is its ability to combine technology, security, and simplicity, without charging the fees that many banks still impose. There’s no required minimum balance, no salary requirement, and you don’t need a perfect credit profile to apply.

On the flip side, it doesn’t offer features like cashback or rewards that some premium accounts provide. But if you’re looking for a checking account that puts flexibility, savings, and full control at your fingertips, this one is definitely worth considering.

All information in this and other BOISLA articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://boisla.com/category/banking/