If you’re looking for more than just a basic checking account—something that rewards you for everyday spending while keeping things fee-free and easy to manage—the Discover Cashback Debit Checking Account might be exactly what you need. Below, you’ll find a step-by-step guide on how to apply, along with some key information to know before getting started.

Fees and Requirements

One of the biggest draws of the Discover Cashback Debit account is its lack of common banking fees. Here’s what you can expect:

- No monthly maintenance fee

- No minimum opening deposit

- No minimum balance requirement

- No fees for overdrafts, non-sufficient funds (NSF), or cashier’s checks

You’ll only encounter a few standard fees, like $30 for outgoing wire transfers. ATM withdrawals are free at over 60,000 ATMs within the Allpoint® and MoneyPass® networks. However, if you use an ATM outside of these networks, Discover won’t reimburse the third-party fee, so it’s best to stick within the network when possible.

International debit purchases are also fee-free, though use is limited outside of the U.S., Canada, Mexico, and the Caribbean. One particularly helpful feature is Balance+ overdraft protection, which lets you overdraw up to $200 on debit card purchases without fees—if you’ve had at least one qualifying direct deposit of $200+ per month for two straight months and maintain a positive balance otherwise.

Keep in mind that these terms can vary slightly depending on your location or banking history, so it’s a good idea to check Discover’s latest account policies.

Who Is This Account Suitable For?

The Discover Cashback Debit Checking Account is a strong fit for anyone who wants more out of their checking account, especially if you’re comfortable with digital banking. It’s great for:

- People who want to earn cashback on everyday debit purchases

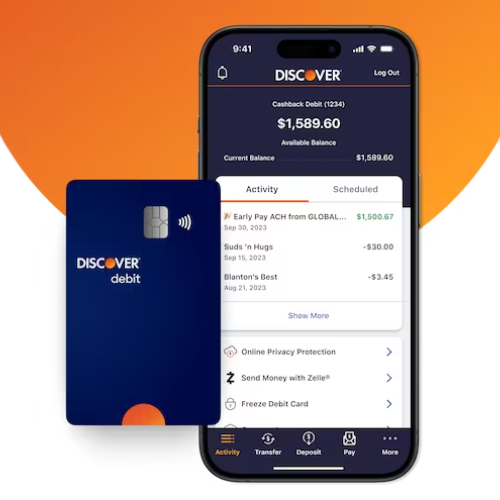

- Users who frequently bank online or through apps

- Anyone looking to avoid common banking fees

- Customers who value overdraft protection and early direct deposit access

There’s no strict credit score requirement, which makes it accessible to a wide range of users. While those with solid financial histories may unlock more perks over time, there’s no minimum FICO score to get started.

Because the entire process—from application to funding the account—is digital, it helps to be familiar with online platforms to take full advantage of the features. However, the platform is designed to be intuitive, even for those newer to online banking.

Is the Discover Cashback Debit Checking Account Worth It?

In today’s world of online banking, the Discover Cashback Debit account stands out as a versatile, rewarding, and low-cost checking option. It’s perfect for anyone who:

- Wants to earn rewards on spending

- Appreciates early access to paychecks

- Needs flexibility with overdrafts

- Wants to avoid the fees tied to traditional banks

While there are some limitations, like no ATM fee reimbursement and occasional automatic transaction blocks or withdrawal caps, these are minor compared to the account’s overall value.

If you’re someone who prefers managing money digitally and enjoys a streamlined, low-hassle experience—with the added bonus of cashback on your purchases—then the Discover Cashback Debit Checking Account is well worth considering. It’s one of the best no-fee, digital-first checking options available today.

All information in this and other BOISLA articles is subject to change over time. Please check for updates directly with the institutions and companies mentioned. Approval is subject to the institution’s review.

REFERENCES:

Read more about banking in https://boisla.com/category/banking/